Best Financial Calculator – 2024 Reviews and Buyer’s Guide

A financial calculator is an essential tool for everyone looking to manage their finances.

A financial calculator is an essential tool for everyone looking to manage their finances.

This goes for you if you are a business person, an actuary, a business student, or if you want a financial calculator for personal finances.

Getting the ideal financial calculator is always a complicated process of trying to strike a balance between the functions and the price you expect to pay for a particular brand.

In this post, we are going to narrow down the top five best financial calculators 2024 in the market.

Best choice for finance

- 12-Digit LCD Display

- Automatic 3-Digit Punctuation

- Arithmetic Logic

- 2 Independently Accessible 4-Key

- Grand Total Memories

- MU Key for Cost/Sell/Margin Calculations

In a hurry? Top Pick is your choice!

Financial Calculators Comparison Chart

[ninja_tables id=”1542″]5 Best Financial Calculators (as of April, 2024):

1. Sharp QS-2130 Financial Calculator – Best for Business Applications Review

- 12-Digit LCD Display

- Automatic 3-Digit Punctuation

- Arithmetic Logic

- 2 Independently Accessible 4-Key

- Grand Total Memories

- MU Key for Cost/Sell/Margin Calculations

The Sharp QS-2130 is an outstanding calculator to help you with all your financial needs. It is a basic calculator with only the necessary settings for a commercial or business setting.

It is a good pick if you work in a retail store and you want to keep tabs on all your finances. Also, if you are an accountant in a finance firm, the features on this calculator will give you incredible performance.

Functionality

A compact, portable size is all the Sharp QS-2130 is all about. You can take it anywhere, and get to tackle all your calculations on the go. Whether you are at home or the office, it provides you the convenience of being able to access all the business calculations with the multiple-key.

A 12-digit display ensures your calculations are accurate each time.

Easy Solving of Complex Math

It is complemented by a second two-key memory function which also comes in handy to skip entries that you have already saved in the calculator for reuse.

Never Run out of Power

With a dual powering system, your calculator is suitable for use day and night. It has a solar energy system as well as a battery backup so that you can make the most out of its capabilities.

With the multiple settings, dual power, and intuitive display, this calculator is an ideal choice for everyday business calculations.

Main Features:

- 12-digit LCD with automatic 3-digit punctuation

- Arithmetic logic

- Two Independently accessible 4-key & grand total memories

- Round-up/off/down, definable adding mode, fixed(3,2,0)

- MU key for Cost/Sell/Margin calculations

- Solar powered with battery backup to prevent memory loss

- It has settings to eliminate errors associated with inconsistent formatting

- Has special keys (4-key memory and independent 2-key memory) for complicated math solving

- Dual power ensures it is usable day and night

- Compact and portable design

- 12-digit display optimizes accuracy

- Produces results super-fast

- The screen is not tilted

Sharp QS-2130 Calculator:

2. Texas Instruments BA II Plus Financial Calculator – Best for Finance Students Review

- 10-Digit LCD Display

- Calculate IRR and NPV

- ime-Value-of-Money Function

- Depreciation Schedules

- Interest Rate Conversions

- Auto Power Down Feature

Texas Instruments BA II Plus comes with lots of financial functions. It can handle both basic and advanced math with ease.

It is a favorite tool for accounting and finance students as it allows you to apply financial instruments in the real business world.

It is also a suitable choice if you are about to sit your CFA as it is permitted for this exam.

Handles Complex Math

One of its offerings is the ability to handle amortization schedules and time-value-of-money problems. You will be entirely comfortable to calculate annuities, savings, leases, mortgages, and so much more.

Not to mention, it can perform cash-flow analysis using IRR and NPV for up to 24 uneven cash flows. This way, you are set to calculate the value of a business and even gauge if it is profitable or not.

Multifunction Features

Texas Instruments BA II Plus gives you lots of methods of calculating interest rate conversions and depreciation.

It also allows you to convert between annual and effective interest rates with ease.

Basic Math Functions

Other keys will help you solve regular financial math like trigonometry, powers, and natural logarithms. It has ten memories to make it easy to store formulas, especially for lengthy math more so in CFA classes.

This calculator proves it is a perfect accessory in accounting, statistics, economics and more so in finance. With the high prices associated with financial calculators, this model gives you durability so that you can depend on it throughout your course years.

Main Features:

- Easy-to-read, 10-digit display

- Prompted display shows current variable label and values

- Calculate IRR and NPV for cash-flow analysis

- Store up to 24 uneven cash flows with up to four-digit frequencies; edit inputs to analyze the impact of changes in variables

- Time-value-of-money function

- Quickly solve calculations for annuities, loans, mortgages, leases and savings

- Depreciation schedules

- Choose from six methods for calculating depreciation, book value and remaining depreciable amount

- Interest rate conversions

- Convert between annual (nominal) and effective interest rates

- It can solve time-value-of-money problems

- It has a prompted display guide

- Comes with a protective cover

- Has a worksheet mode

- Ten memories

- Automatic power down preserves power

- It does not support solar energy, so you need to replace the battery after a few months so that you don’t risk it dying on you in an exam.

3. HP 12C Platinum Financial Calculator – Best for Finance Professionals Review

- 1-Line-by-10-Character Display

- Over 130 built-in Functions

- RPN & Algebraic Data Entry

- Keystroke Programming, up to 400 Steps

- Carrying Case & Long-Life Battery

It’s impressive that a calculator can be in the market 30 years after its first production.

Maybe it’s because of its durability, or it is its excellent battery life. Either way, HP 12C is here to stay.

From actuaries to money managers, auditors, product managers, and many others, one calculator lies on their desks, and they all love it the way it is.

Reverse Polish Notation (RPN)

As we say in business, time is money and a calculator that puts value in time is worth any computer app. This calculator also has an algebraic entry system with parentheses.

Over 100 Financial Functions

HP 12C can handle up to 80 cash flows thanks to the memory function. The same memory can handle up to 400 steps for the 130 functions. It provides you with a nice mix of finance, business, and statistics allowing you to solve all types of math problems in your sector.

This includes time-value-of-money math and creation of amortization schedules with the help of NPV and IRR. It can also store your custom programs for future calculations of cumbersome problems.

Display

You have a one-line 10-digit display. It is on an adjustable contrast LCD which allows you to change the brightness to suit the exterior conditions.

Being able to adjust contrast eliminates eye strain if you are in a low lit environment. It also allows you to read the results fast and smooth with a light setting that suits your eyes.

Build Quality and Battery Life

One of the reasons this calculator has managed to stay in the market for so long is its shock resistance. Whether you work in the office or you spend your time in the field, you will at one time drop your calculator on the floor.

If it is a concrete floor, you can end up with a cracked screen or jammed keys. But not with the HP 12C. It is rigorously tested for falls that’s why you will spot it in just about any environment.

Looking at the battery life, HP 12C is powered by one CR2032 battery. It continues to provide similar long-term performance. Some users indicate they have not replaced their batteries for over a decade. It goes on to say the kind of reliability you can only get on HP 12C.

Main Features:

- Simple, easy-to-read 1-line-by-10-character display

- Over 130 built-in business, financial, statistical, and math functions

- RPN and algebraic data entry

- Keystroke programming, up to 400 steps

- Includes carrying case and long-life battery

- Keystroke programming with up to 400 steps

- RPN and algebraic data input system

- Approved to sit key exams like CFA, CFP, and GARP FRM

- 10-digit display

- Contrast is adjustable for any lighting setting

- 130 finance functions

- It has both undo and backspace buttons

- It takes time to learn and master using this calculator, but there is an online training program. Once you get past the basic level, every other function is a breeze to learn.

CFA Tutorial: NPV for Uneven Cash Flows using HP12c:

4. HP 10bII+ – Best Easy to Use for Business and Finance Students Review

- 12-Digit Display

- 6 Regression Options

- 22-Number Memory Storage

- Over 170 Built-in Functions

- Intuitive Keyboard Layout

HP continues to stand out as a reliable brand in the production of financial calculators. This particular model; the HP 10bII+ is a straightforward tool to use as it has a smooth learning curve.

You can gain access to its 170 functions and get the most out of it. It leans on exquisite performance for everyone who wants a financial calculator for statistical and business purposes.

Powerful Performance

With an algebraic data entry system, it gives you a simple way to input numbers allowing you to get the most accurate answers. There is no room for mistakes, and this calculator gives you precisely that.

All your Courses are Covered

HP10bII+ is a useful tool from your first year of college. It will help you through introductory accounting, business, finance, banking, to science, mathematics, and even statistics.

It will grow with your needs from when you will be handling probability distributions to the most complicated econometrics class.

Display

A 12-digit display gives you top accuracy. You will find it exceptional as you can adjust the brightness to suit your eyes and your current lighting conditions. Not to mention, it produces fast results without delay. It will save you time so that you can handle more math and accomplish your goals.

Investing in the HP10bII+ guarantees you ease of use, suitability in exams, durability, and style. You don’t want to go to your next class without the HP10bII+.

Main Features:

- HP 12-digit calculator offers 6 regression options

- 22-number memory storage

- Over 170 built-in functions including probability distributions

- Intuitive keyboard layout with minimal keystrokes required for many common functions

- Easy-to-read display with adjustable contrast and on-screen labels

- Permitted for use on SAT, PSAT/NMSQT and College Board AP tests

- Meets CFP, SAT, College Board AP Tests, and PSAT/NMSQT exam requirements

- Provides 22 memory registers

- The 12-digit display has adjustable contrast

- Uses algebraic data entry

- It has functions for time-money-value problems, NPV, IRR, etc.

- It has limited editable points

Time value of money (using HP 10bII+):

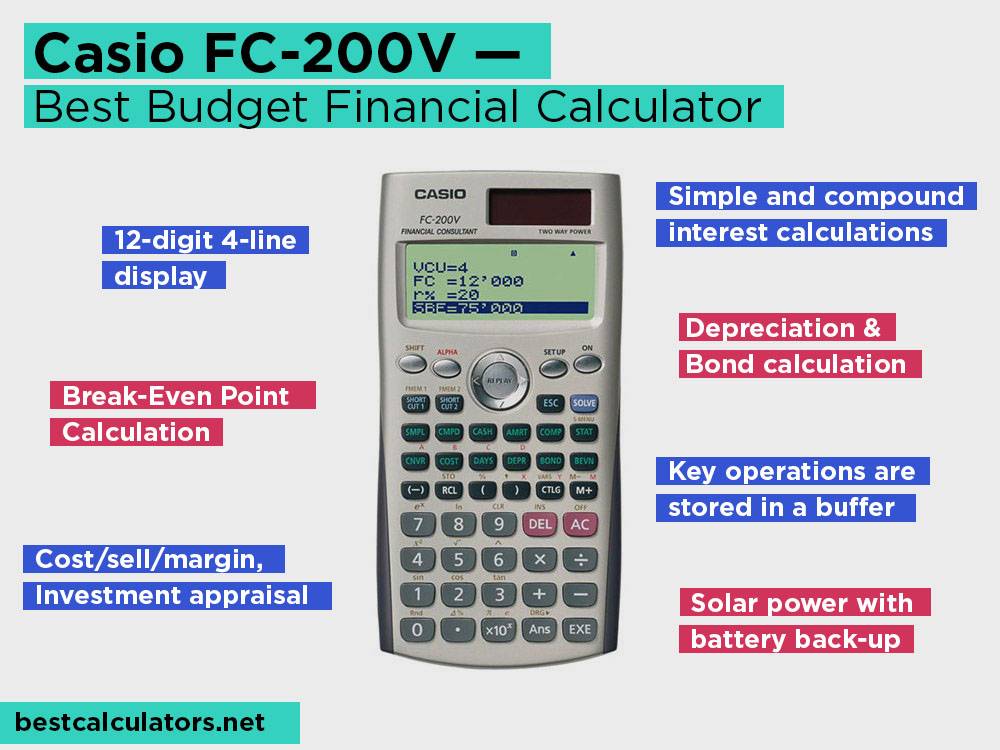

5. Casio FC-200V – Best Budget Financial Calculator Review

- 10 + 2-Digit Display

- Cost/Sell/Margin

- Investment Appraisal & Amortization

- Key Operations are Stored in a Buffer

- Solar Power with Battery Back-Up

Casio is one of the favorite calculator producers on the market. The Casio FC-200V model offers simplicity, excellent performance, and durability in an affordable package.

It comes with a hard case to protect it from damage when you drop it. We can tell you are getting a reliable product that will last you years.

Multifunction Keys

You also have access to the simple interest key, compound interest, investment appraisal, statistical and regression, interest rate conversion, amortization, and many others.

Thoughtful Features

This calculator allows you to create shortcuts. You will be able to assign a parameter value or setting, to one of its shortcut keys so that you can recall it later for simpler and faster calculations.

This eliminates the need to keep repeating a sequence of inputs when handling similar problems in the future. You will be more efficient and be able to handle more financial calculations.

Display

Casio goes away from the norm by giving you a 12-digit 4-line display. It does not only offer you more accuracy, but you also get more details so that you can relate the question to the answer.

We like that it has hard plastic keys making it easy to input numbers since you will be sure when you key in any number.

Casio FC-200V is an intuitive model. It gives you true value for money. From being able to handle complex financial computations to simple investment appraisals, you are not about to get disappointed with it.

Main Features:

- Large, easy-to-read display

- 10-digit mantissa + 2-digit exponential display

- Cost/sell/margin, investment appraisal, amortization

- Converts between percentage interest rate and effective interest rate

- Key operations are stored in a buffer, so nothing is lost even during high-speed input

- Plastic keys

- Solar power with battery back-up

- It has a full dot, 12-digit 4-line display

- Can convert percentage interest rates and effective interest rates

- Comes with a slide on hard case

- Uses both solar power and a battery for backup

- It has shortcut keys for future recall

- It does not save time on the input method when tackling simple math like with the RPN method

Best Financial Calculator – Buyer’s Guide

Some people say you need to be an expert at finding the best financial calculator. But we do not agree. With these pointers, you will be confident when picking your next financial calculator.

Why should you use a financial Calculator?

Students in financial classes fall under the first category of using a financial calculator. If you are taking a course in financial management, you will be asked to bring a financial calculator.

The other category is business professionals and individuals who want to manage their finances. It is difficult to manage your income let alone other peoples ‘money.

Even as difficult as it sounds, financial calculators come in to help and save you time and money while bookkeeping.

Advantages of a Financial Calculator

They solve Time-Value-of-Money Problems

One of the main reasons for getting a financial calculator is the ease of solving time-value-of-money problems. You will mostly encounter questions about the amount of money an investor will have after a couple of years saving and earning interest.

With a financial calculator, you will be able to enter the parameters surrounding that question to get an accurate answer.

Solves a wide variety of financial problems

Apart from time-value-of-money questions, these calculators allow you to acquire answers to such questions of net present value, internal rates of returns, discounted cash flows, markup, and loan formula calculations.

Make Basic Statistics look Easy

Statistics involves a lot of steps. To avoid constant repetition, a financial calculator allows you to perform the calculation automatically by entering the data. This way, you can quickly solve for regression, weighted averages, and correlations.

Disadvantages of Financial Calculators

Requires Learning to use them. If you are unfamiliar with a financial calculator, you will likely lose your way and be unable to get correct answers.This means you will need to take your time and learn how to use the different keys.

Common Functions on a Financial Calculator

With the calculator in the finance mode, everything else falls into place since you don’t have to calculate percentage as the calculator will do it automatically using the tax, before tax, discount, and markup functions.

The interest rate and discount rate use the rate button which is also used to convert between current interest rates and effective interest rates.

The time-value-of-money is a group of functions for future and present value of a series of regular payments. They are usually used for loans, annuities, and mortgages with the help of three features (PV, FV, and TM).

What are the Differences Between a Financial Calculator and a Scientific Calculator?

A financial calculator is designed to solve problems associated with business and commerce. The keys are standalone representing specific finance functions. But a scientific calculator is not specific on the keys.

They provide functions for mathematics, science, and engineering courses. These include such features as scientific notation, floating point, trigonometric functions, exponential functions, and logarithmic functions.

Financial Calculator vs. Excel Computer Program

Excel has continued to have a significant impact in the business setting. You just create a worksheet, and you start punching the necessary data.

Excel is preferred because it is less messy when it comes to solving long financial problems. And if you make a mistake, you can retrieve or backtrack to know where you went wrong because it saves your work.

That said, Excel is a good option in an office where there are no restrictions on the usage. But you cannot take your computer to an exam room. It is limited to where you can take it. As such, it is always good to get accustomed to the two so that you can get the most from both worlds.

Financial Calculator vs. Basic Calculator

A basic calculator has only four functions. That is; addition, multiplication, subtraction, and division. Some include the percentage, mean, and square root functions, but that is as far as they get.

Which is Better: Texas Instruments or HP Financial Calculator

We compare these two calculator brands mostly because they provide the required calculators for major exams like the CFA exam.

Texas Instruments produces calculators that are easy to learn and use especially when we compare the Texas Instruments BA II Plus and the HP 12C. Texas Instruments also sell their financial calculator at a lower price than HP, but it does not have a durable look like that of the HP.

HP financial calculators remain in use years after their production. They offer different input methods like the RPN. This means you will have to learn this input method if you are not familiar with it.

But you get a calculator that will last many years in good use and without requiring a battery change.

Conclusion

Financial calculators are explicitly created for finance problems. With the above list of the best financial calculators, we hope you will find the right model for you.

We picked these models based on thorough researching top performing brands. We believe they will serve you well both in class and in the finance sector.

Try one of these for an easy time the next time you are tackling financial problems.

i personally liked Casio FC-200V . i am planning to buy it as i need it for my financial needs. again thanks for this great detailed article

excellent work but I found something missing so if you want I will tell you that thing.